Date: May 22, 2018

Morning Ag Markets

Pete Loewen

Big sigh of relief for the cattle complex yesterday as futures shot actively higher and escaped the potential in the short term at making new contract lows. Last week, October live futures dipped into life of contract lows, but for the 2018 live and feeder contracts, that was it for new low territory. Everything else managed to hold that massive area of support. Technical analysis based on that move towards the April contract lows looks well supported now. It’s not that new low ground isn’t possible, but for the time being at least, the path of least resistance appears to be up.

Oddly enough, that up move, if it keeps marching higher is going to be counter to the fundamental indicators. Choice cutouts that had rallied about $20 since April 19th have been down now in 4 of the last 6 business days. Cash feedlot trade was all over the place last week, but all of it at quite a bit lower levels than the previous week.

On Friday we get monthly COF numbers released. The range of guesses for those numbers have the On Feed total on May 1 between 104.1% and 105.3% of a year ago. Placements in April were down sharply from the previous year with the range of estimates from 85.6% up to 94.2%. Some of that decline was cattle going back out on ailing wheat pasture and another part of the downfall was the big run of Wheaties that happened in November and December because they ran out of wheat grazing from the drought. Either way, we’re also faced with the fact last year’s placements from March through the end of 2017 were up sharply, so it’s not like a shorter run this spring wasn’t expected. Placement rates will pick up again starting in June and we’ll have quite a few months with in-movement larger than year ago levels through the balance of 2018. The marketings in April are expected in a range of 105.7% up to 106.3%. The majority of that increase in marketings can be attributed to an additional business day in the month of April. That accounts for about 4% of that increase and certainly tames the friendliness potential.

Cattle slg.___120,000 +3k wa +4k ya

Choice Cutout__230.82 -1.39

Select Cutout___207.52 -.94

Feeder Index:___133.63 -.03

Lean Index.__68.38 ++.64

Pork cutout___76.10 +2.19

IA-S.MN direct avg__63.66 -1.39

Hog slg.___ 457,000 -2k wa +17k ya

*****************************************************************************

Grain and oilseed trade was exciting and disappointing at the same time yesterday. Soybeans shot higher on the news that China was backing down on all sanctions in the ag trade. That’s friendly beans and it should be friendly for milo again as well, although I’ll have to see it in the export inspections in coming weeks to confirm that the potential is becoming reality. The disappointing side of the trade yesterday was wheat being down in the double digits in KC and Chicago. I honestly have nothing to attribute that price drop to and after watching the overnight shoot back higher and erase most of those losses, it appears wheat has a shot at redemption today if it can hold the gains.

Export inspections yesterday, which is data for the week ending May 17th showed a bullish corn and soybean number and bearish wheat. Corn inspections were 60.2 mln bushels compared to 46.4 in the same week last year. We need to see 53.1 mln per week to hit the USDA target for the marketing year that ends on the last day of August, so that number was ahead of the pace needed.

Soybean inspections for export totaled 32.8 mln bushels, versus 12.1 in the same week last year. The pace needed in beans to hit the target is 25.9 mln, so that was above the levels needed, just like corn.

Wheat didn’t look very promising. Total shipments were 12.5 mln bushels which is less than half the amount we had in the same week last year. We need 31.4 mln bushels per week over the next two week’s reports when the marketing year ends on the last day of May. If wheat doesn’t hit those numbers, exports will come in lower than the USDA projection and ending stocks will likely go up even more for old crop. Every little bit that old crop stocks go up is carried into new crop, which makes the new crop picture a little less bullish.

Fund activity yesterday was reported as sellers of 4000 corn, 9000 wheat and buyers of 10k beans.

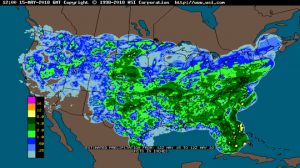

Crop progress and condition data showed winter wheat conditions unchanged at 36% g/ex and 35% p/vp. Last year it was 52% g/ex and 15% p/vp. HRW wheat actually got 1 point better to 19% g/ex and soft was 1 point better as well up to 66%. White wheat got worse, which kept the overall number unchanged. Kansas is sitting at 14% good and 1% excellent, along with 47% p/vp. Oklahoma is 11% good, 1% excellent and 61% p/vp. Texas is 16% g/ex and 62% p/vp.

Spring wheat seeding made huge jump up to 79% compete, which is only 1 point behind the normal pace. North Dakota was 7 points ahead of the normal pace, but still has 1.4 mln acres to plant. The South Dakota pace was right at normal, Minnesota is 5 points ahead of normal and Montana was 20% behind normal.

Corn planting nationwide hit 81% done, which is right at the average pace. Iowa is 2 points behind normal, but gained 20% last week. Illinois is 9 points ahead of normal and only 4 points shy of 100%. Minnesota is 7 points behind the average, but got 37% of the crop in last week. Nebraska rounds out the top four corn producing states at 88% complete which is right on the average pace and was up 16% from last week.

Soybean seeding made a huge leap up to 56% done, which was a 21% gain in one week, along with 12% ahead of the average pace for this time of year. Illinois and Indiana are just shy of double what they’d have planted in a normal year. Iowa is ahead of the average pace by 7 points. Ohio is 13% ahead of normal and Missouri was 30% ahead. South Dakota continues to ride the struggle bus this year and until this week, Minnesota was on that same bus. South Dakota is 15% behind normal in corn planting, 20% behind normal in soybean seeding, but they are right on the normal pace in spring wheat.